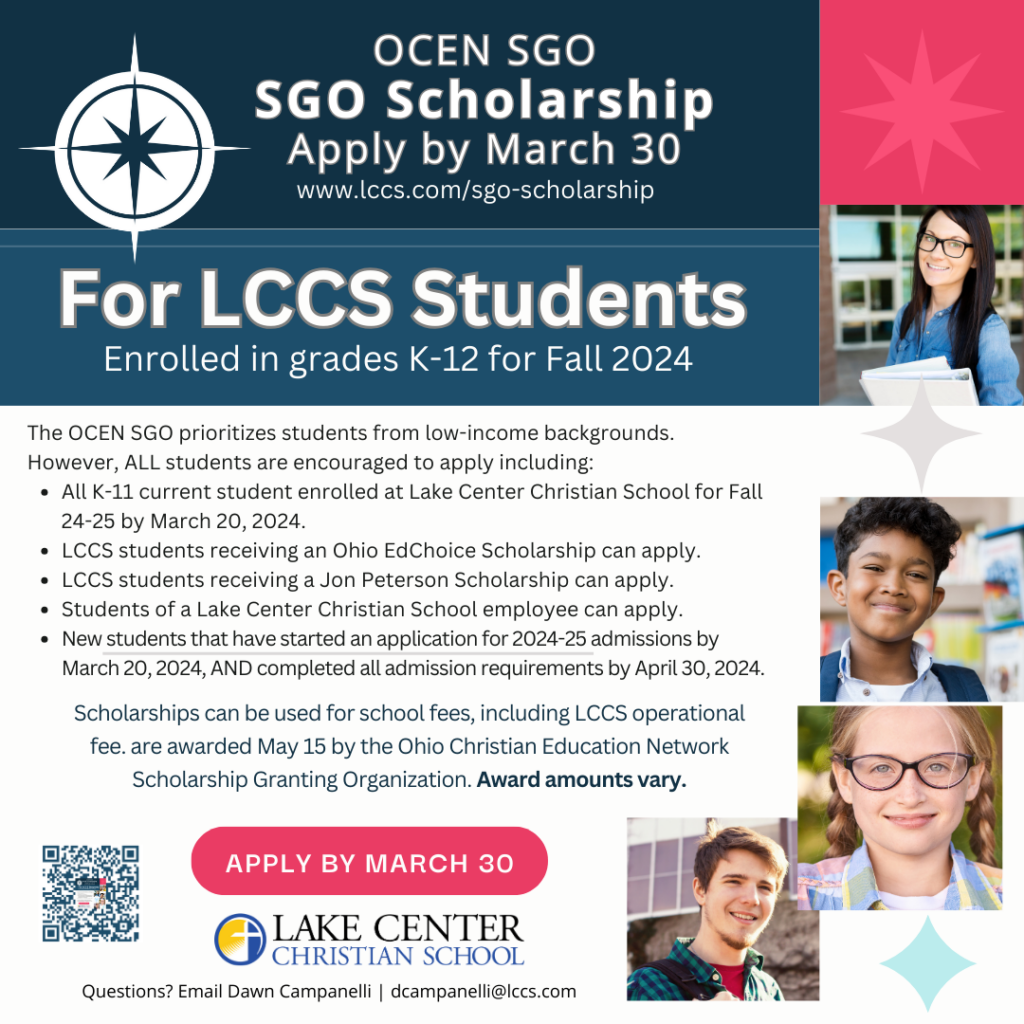

Scholarship Opportunity

for Lake Center Students

Submit an OCEN SGO Scholarship Application for your student by March 30, 2024

The Ohio Christian Education Network Scholarship Granting Organization (OCEN SGO) is a scholarship opportunity for K-12 students attending Lake Center Christian Schools. Award amounts vary.

The OCEN SGO prioritizes students from low-income backgrounds. However, ALL students at participating schools are eligible to apply, including:

- All K-11 current student enrolled at Lake Center Christian School for Fall 24-25 by March 20, 2024.

- LCCS students receiving an Ohio EdChoice Scholarship can apply.

- LCCS students receiving a Jon Peterson Scholarship can apply.

- Students of a Lake Center Christian School employee can apply.

- New students that have started an application for 2024-25 admissions by March 20, 2024, AND completed all admission requirements by April 30, 2024.

For Lake Center Christian School (2024-2025 school year) the student application window closes on March 30, 2024.

Awards will be announced on May 15, 2024. Award amounts vary based on applicants and funding available from year-to-year. All Ohio taxpayers are eligible to claim a dollar-to-dollar reduction in your state tax liability up to $750 per taxpayer. A married couple filing jointly can make two gifts and claim a credit of up to $1500. Learn more and make a donation at LCCS.com/SGO.

Thank You!

For the 2023-24 School Year $82,140 in OCEN SGO scholarships were awarded to 220 new and returning students.

Scholarship Application Process:

Complete the short online scholarship form at: https://ohiocen.org/sgo/

- Student first and last name email, grade level

- Parent name, email, and family address

- School attending Fall 23-24

- Family total income as calculated on your 1040 line 9.

Upload your recent tax return that lists the student applicant(s) as dependent(s). If your family tax status is Married Filing Separately please upload both spouses’ tax returns.

If you do not have a federal tax form, you will need to submit two most recent pay stubs for all wage earners in the family, along with an explanation of why your family does not have a tax return to [email protected].

FAQs

The scholarship is designed to help students have access to a Christian education and encourage participation in extra-curricular activities that strengthen academic, spiritual and mental health needs of our students through participation in clubs and activities. At Lake Center, the OCEN SCO scholarship can be used to cover:

- Tuition

- Operational Fee (updated 11-23-23/approved by LCCS Finance Committee)

- Tutoring Services

- Academic Field Trips (6th Grade Beaulah Beach; 10th Grade Washington DC.)

- Academic Fees (including graduation fees)

- Music Fees (excluding private lessons)

- Choir Festival

- Instrument Rentals

- Athletic Fees (All grade levels)

- Fine Arts Play Fees

- Club Fees (K-12)

Updated 11-13-23. YES.

On November 13, 2023, the Lake Center Finance Committee approved making the operational fee an additional fee that can be covered by the OCEN SGO scholarship. Any balance for the operational fee not covered by the OCEN SGO scholarship is the responsibility of the parent/guardian to pay. scholarship at Lake Center.

No. The Mission Trip funds are paid to a third-party entity and is not eligible to be covered by the OCEN SGO scholarship at Lake Center.

No. Application, enrollment, continuous enrollment, student commitment fee and testing fees that are part of the Admissions process are the responsibility of the parent/guardian and not eligible to be covered by the OCEN SGO scholarship at Lake Center.

Yes. The OCEN SGO scholarship does not replace the Ohio EdChoice scholarship. If your student is also awarded a OCEN SGO scholarship, those funds can be used to help cover the fees of voluntary participation in academic, field trips, athletic teams, and clubs to enrich their learning experience at Lake Center.

No. OCEN SGO Scholarship awards are NOT transferable. Each student must apply for the OCEN SGO scholarship. The deadline is February 15. If your student receives an award and no longer plans to attend, or withdrawals from Lake Center, any unused OCEN SGO scholarship award funds will be forfeited.

You can make a donation to the OCEN SGO all year round through one-time, monthly or quarterly recurring donations and designate Lake Center Christian School to receive funding.

The Ohio budget passed in July 2023 added a provision to allow for nonrefundable Ohio tax credits for SGO donations for the

2023 tax year to be made until April 15, 2024. This means that a donor could give to the SGO up to April 15, 2024 and still

have the tax credit applied to the 2023 tax year. Those tax credits remain at $750 per individual/$1,500 for married

filing jointly.However, you can only claim the credit amount donated (up to $750 per individual; $1500 per couple) on your Ohio tax return in the year that it was donated. For example donations Jan 1, 2023 – April 15 2024 can be claimed in the 2023 tax year.